Car in your bussines

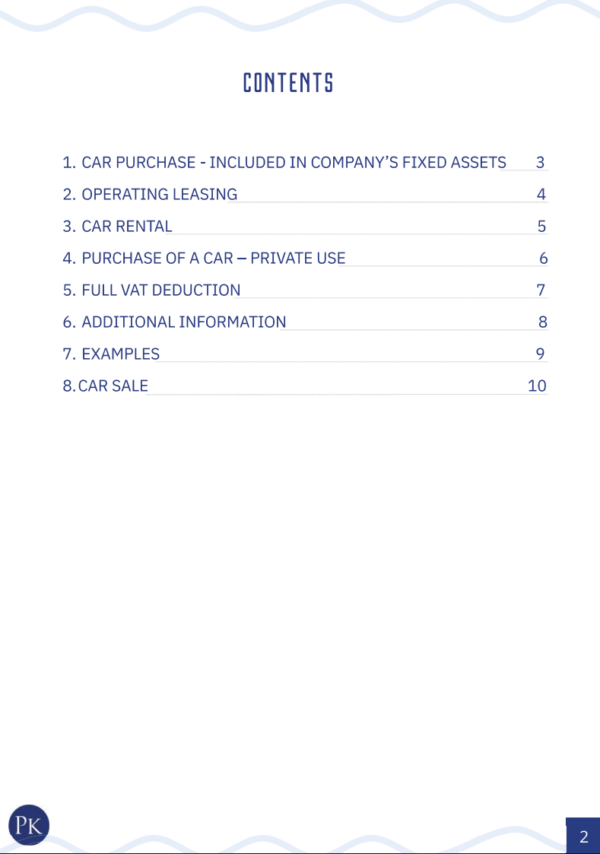

A practical guide for companies and sole traders explaining the rules for accounting for company cars. The document presents the possibilities and limits for recognising expenses as tax-deductible costs, including VAT deduction rules and differences in accounting depending on the chosen form of taxation.

Price range: 121,77 zł through 183,27 zł z VAT

Do you have questions?

Fill in the form below and we will contact you as soon as possible